An alternative way to invest

Diversify your investment portfolio with a solid alternative to stocks, bonds and real estate. Over the last 6 years investors have received more than a 7.5% annualised return.

Receive our free information package on crowd lending as well as our newsletters and monthly reports

Experience

investors

Visualize your potential earnings

The calculations below is based upon the moderate scenario in our Key Investor Information Document. Expected return is 7.37% per year over a 5 year investment horizon

DISCLAIMER: Alert: You are about to purchase a product that is not simple and may be difficult to understand. Past performance is no guarantee for future performance. Please consult your own independent financial advisor before you invest.

Quantrom's results speak for themselves

Return compared with other asset classes

Compared with other European asset classes over the past 6 years, Quantrom P2P Lending comes out quite favourably. Over the last 6 years. Since 2017 Quantrom P2P lending has given our investors a return of more than 60%.

Returns comparison since March 2017

Stable returns year-on-year, regardless of external factors.

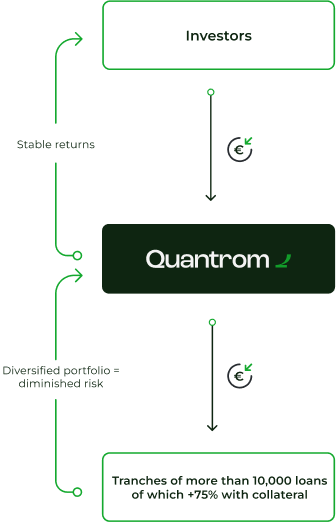

What is Quantrom?

Quantrom P2P Lending DAC, or simply Quantrom, is a company established in Ireland with the purpose of investing in alternative lending, which is lending over the internet.

People can borrow to renovate or build a property, buy a car or acquire consumer goods. You can best compare it with “old-fashioned” mortgage deeds with different types of collateral.

Investing in Quantrom is done by subscribing to profit participation notes, which is a financial investment where the noteholder gets a share of the profit each month. Our profit participation note is accumulating, which means that the profit of each month is added to the value of the note.

Our core investments are in car, property or business loans among others, however, it is important to point out that we do not invest in pay-day loans.

Loans by type

Over 75% of our portfolio is invested in collateralized loans.

Our lending

Quantrom focuses on 4 types of P2P loans: Car loans, Property loans, Business loans with collateral in properties, and Personal loans. This type of lending is the equivalent of “old-fashioned” deeds that have moved online.

Why invest with Quantrom?

Stable returns

Our approach to alternative lending has been developed in order to minimize volatility and reduce the potential risk to your funds.

Over 75% of our loan portfolio is backed by collateral and buy-back guarantees. We have successfully brought a stable annualized return of 7.5% to our investors during the last 6 years, regardless of market events, e.g. COVID-19, that had an adverse effect on other investment solutions.

Subscription & redemption

It takes 3 easy steps to invest in Quantrom. Your subscription to Quantrom is very transparent and handled online. After subscribing, you transfer your funds to our client account in the Bank of Ireland. Our transfer agent – DM Financials – will execute your subscription and register your profit participation notes. A minimum investment period of 12 months applies. Should you decide after 12 months to redeem your notes, it will be as easy and transparent as the subscription process.

Trustworthy partner

With Quantrom you do not need to worry about hidden fees, high transaction premiums, bid-offer spread or unexpected costs that diminish your overall return. Our process is completely transparent and all details of our investment procedure can be accessed freely. Our monthly reports will describe every facet of our portfolio. Whenever you have questions, contact us (via email) or book a call.

Cost Transparency

A subscription in Quantrom P2P Lending DAC profit participation notes will include a subscription fee of EUR 50. An annual management fee of 1% of the asset under management is charged, as well as a performance fee of 10% of the annual return beyond 7%. When redeeming profit participation notes a fee of EUR 50 is charged.

As an example, if you were to invest EUR 100,000 on the 31st of December 2019 and held the investment until the 31st of December 2021, after which you would redeem the entire holding, the outcome would be as follows:

Upon subscription, you would be assigned 79,570.00 profit participation notes, the equivalent value of EUR 99,950.66.

Upon redemption you would receive the value of EUR 114,121.84 EUR for your PPNs and be charged a fee of 50 EUR, resulting in a total amount for withdrawal of 114,071.84 EUR. This will result in a total return for the period of 14.13% after all fees and costs.

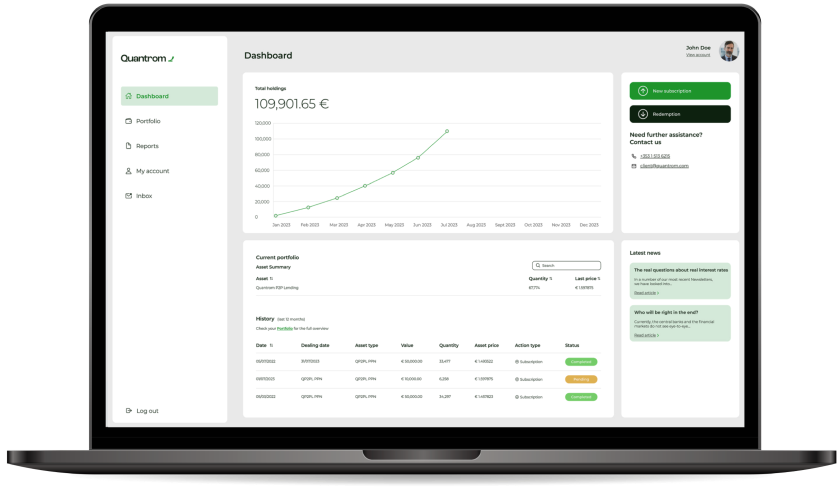

Quantrom Portal

We created a place where you will be able to view and manage your investment.

Quantrom portal is your one-stop online application for managing alternative lending investments. It offers a quick-view dashboard, real-time portfolio valuation, insightful performance reports, and timely notifications - all streamlined for optimal investment strategy planning.